The retail industry has experienced a major overhaul in recent years in response to the skyrocketing growth of ecommerce. As more consumers spend their money online, many long-standing retailers have been forced to close some or all of their physical locations to remain profitable. Brokerage firm Credit Suisse predicts that nearly 9,000 brick-and-mortar stores will close by the end of 2017.

While traditional retailers are shutting their doors, ecommerce moguls are swooping up this abandoned real estate for opportunities to expand their online retail operations. Many companies are flipping the vacant buildings located in prime metropolitan locations into fulfillment or distribution centers, known as urban warehouses, to boost their warehouse network.

Urban warehouses are an innovative way to service heightening customer demands while maintaining a healthy profit. By opening a fulfillment center in a densely populated area, whether in a vacant building or through new construction, retailers gain quick access to a large volume of people.

Along with urban warehouses providing online retailers with more room to grow and store inventory, moving product to the center of major cities offers other competitive advantages as well.

Quick Shipping

Speed is key in the customers’ mind. Amazon has conditioned shoppers to expect fast and free shipping and 69 percent of online shoppers agree that one-day delivery is an incentive to buy online more. However, the operational costs associated with expedited shipping often times don’t make it a viable option for many companies with warehouses in less centralized areas.

Operating fulfillment centers in urban areas translates to faster delivery times because your customer could be located only a few miles away. Ideally, you want your facility to be within 30 minutes of the city center during non-rush hour periods so you can ensure overnight delivery or, even better, same-day delivery. Alternatively, during the peak season, it may make sense to augment your permanent operation with a pop-up fulfillment center that is located near several major urban areas.

If the current delivery trends stay consistent, there will be 500 million deliveries a day to city shoppers by 2025. This increases the need for companies to optimize their mobility and place high-demand items closer to the consumer.

Millennial Proximity

Millennials ushered in the rise of online shopping and, as they’re aging and exerting their buying power, they continue to choose to buy online as opposed to in-store. It’s advantageous for retailers to follow Millennial trends because of their purchasing power, and their location of choice happens to be in major cities now. In lieu of big houses and backyards, many Millennials migrate to major cities in search of richer, intangible life experiences, setting them farther away from rural fulfillment hubs.

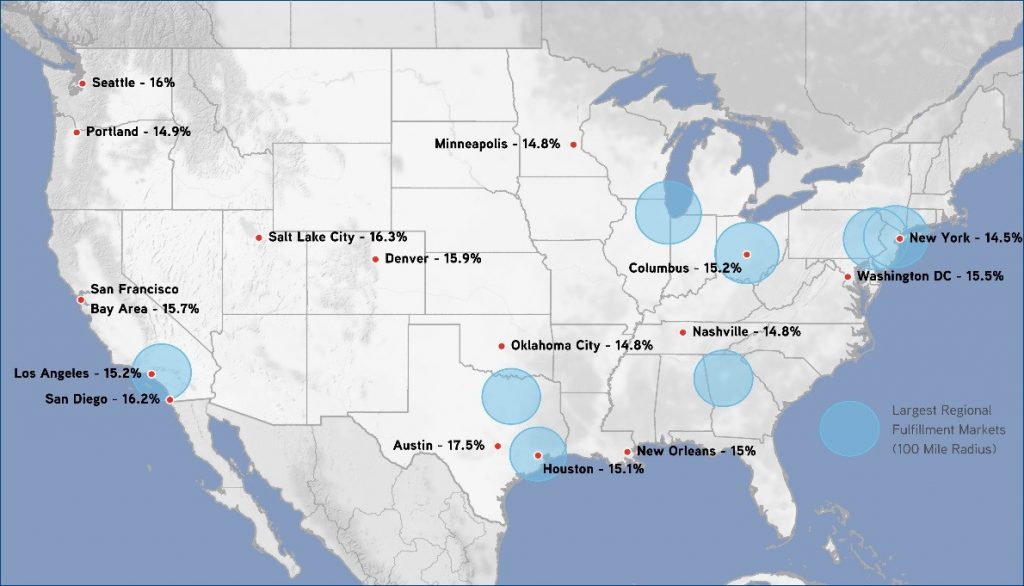

Now, it’s more logical for warehouses to be located in urban areas to better service their key customers. Global commercial real estate organization Colliers International created the above map, which illustrates the disparity between Millennial residences and warehouses. The blue rings are a 100-mile radius around major warehouse markets and the red dots indicate cities with the highest percentage of a Millennial population.

As you can see, the rings and dots overlap in some areas, but there are many major Millennial cities that are far removed from a warehouse market.

Last-Mile Shipping Options

Traditional delivery providers such as UPS and FedEx monopolize and dominate shipping, allowing them to have the upper hand in pricing negotiations. However, urban warehouses have a wider selection of delivery options due to the expanding list of on-demand apps providing cheaper shipping services. For example, same-day delivery service UberRUSH or Roadie, which directly competes in UPS’s and FedEx’s territory.

Additional Considerations

While operating a fulfillment center in a densely populated city is beneficial in several ways, there are a few things to consider before moving part of your operation.

First, the amount of required space needs to be assessed. Whereas large warehouses nearing one million square feet are becoming more common in rural areas to accommodate growing inventory and orders, a warehouse this size cannot be placed in the middle of a bustling city. Instead, these urban warehouses likely range from 20,000 to 70,000 square feet to fit within the surrounding buildings. The size constraints require companies to determine which products have a high order frequency in the area.

Additionally, you’ll want to upgrade your warehouse management system (WMS) to ensure data integration between your urban warehouse and larger center outside the city. A weak WMS can result in inaccurate inventory numbers and can lack the sophisticated functionality you need to optimize multiple operations.

Also, when you choose where to locate new warehouse space, make sure to consider urban warehouses in secondary markets.

Finally, you need to determine the best workforce strategy to support the fast-paced environment of an urban fulfillment center. The number of workers will be constrained by building size, so every associate will need to be able to pick and pack an order quickly and efficiently to meet strict timeframes. In addition to a high volume of orders, more online shoppers are likely going to expect quicker shipping during busy holiday seasons, so your urban warehouse will need to be able to flex its workforce proportionately.

If you choose to relocate portions of your fulfillment operation, your current warehouse may have extra storage space. Find out if you should utilize that space for your distribution operation by checking out our blog, Should You Combine Your Fulfillment and Distribution Operations?